Replacement of existing Asset with a new asset

Replacement of existing Asset with a new asset

In this analysis, the annual equivalent cost of each alternative calculated first. Then the alternative which has the least cost should be selected as the best alternative.

Capital Recovery with return

Capital

recovery cost computed from the first cost (initial investment/ purchase price)

of the machine.

Generally,

as an asset becomes older, its salvage value becomes smaller. As long as the

salvage value is less than the initial cost, the capital recovery cost is a

decreasing function of the life of the asset. In other words, the longer we

keep an asset, the lower the capital recovery cost becomes.

|

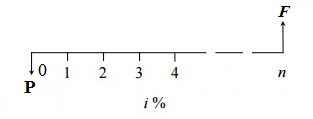

| Capital recovery with return |

Here,

P = Purchase price of the new machine or

present value of the old machine

n = Remaining life of old machine in years or

useful life of new machine in years

i = interest rate compounded annually

F = Salvage value at the end of machine life

The

equation for the annual equivalent amount for the above cash flow diagram is

AE(i)

= [(P – F )*(A/P, i, n)] + (F*i)

This

equation represents the capital recovery with return.

If

we consider annual maintenance cost of a machine, then the cash flow diagram is

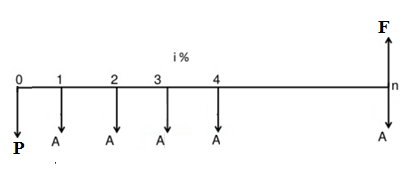

|

| Capital Recovery with maintenance costs |

The

equation for the annual equivalent amount for the above cash flow diagram is

AE(i) = [(P – F )*(A/P,

i, n)] + (F*i) + A